Technology is playing a vital role in simplifying processes, which earlier required many days to process.

Thanks to digitisation, every single task can now be performed at a click of a button on your smartphone. But, did you know your eKYC, in the financial world, is not digital.

Oh, yes, the bank sends some agent to your house with a smart tablet. He then proceeds to take your pictures and upload the submitted documents on the bank’s app. Is that digital eKYC?

No!

So, what is real eKYC? These days everybody believes that eKYC is done and everything is Honky-Dory, but go to a bank and you will see that the backend processes are not digitised. There is a lot more paper-work than you can imagine.

In our path towards e-banking, we need to solve eKYC with paperless and automated methods. Hence, this has opened the door for startups such as givfin to digitise lending institutions completely. Just remember for us digitisation means no paper, least amount of human intervention, and data analytics at speed.

Why is eKYC misunderstood?

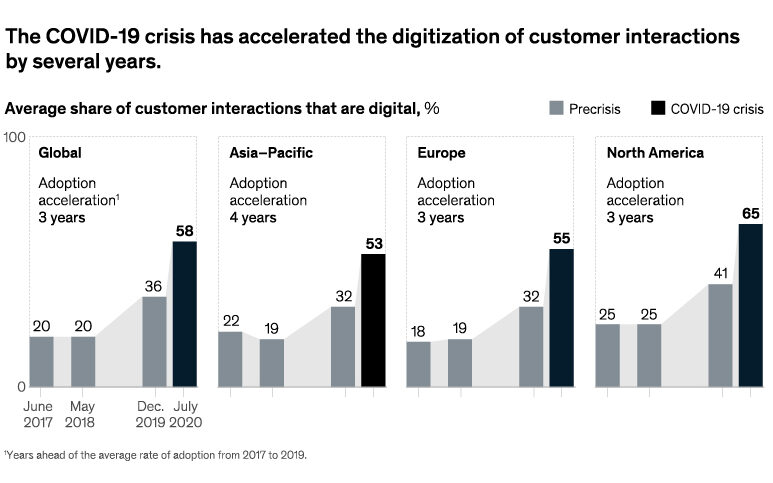

The past two decades have seen a rapid shift in technology, corona pandemic has also played a huge role in accelerating the shift. What can’t be ignored amid all this is the acceptance of digitalisation in all aspects.

We are in a period of transition and complete digitization is slowly being accepted and criticised less. People cannot be blamed for misunderstanding eKYC.

Let us understand why there is rapid digitisation. In the era of the internet everything works on data and the process of running an organisation with real-time data for business efficiency is called digital transformation.

We are living in the era of automated programming interface (API) where applications of an organisation or third-party apps talk to each other to exchange data.

APIs are taking over manual communication. APIs are eliminating the work of physical walk-in verification where everything is automated.

Verification of documents doesn’t need an agent or a person to evaluate the customer.

Everything is now available and done within a few clicks.

It sounds easy, but, why are banking systems yet to adapt to the complete digitisation of KYC is a question we want to answer in this blog.

Are banks ready?

Not entirely! Banks are still grappling with digital transformation. They find it difficult to transition from legacy-based core banking systems and paper-led models, which only allowed them to track liabilities, such as customer deposits, with paper verification made only during an opening of an account.

Remember banks don’t make money on deposits, they make money when it is lent. So, lending is where digitisation is yet to take its proper shape and form. We in the industry still believe that an agent coming to the house and taking a few photos and scanning a few documents has made things digital.

Even having a smartphone app after paper verification is not digital. Banks have so much paper as a matter of compliance makes digitisation a difficult proposition.

When you lend to a customer in the era of the smartphone where social media data, Aadhar led verification and video based identity verification are available, banks should make their back end processes ready for complete digital KYC. What we mean is that there should be no paper even at the bank processing level.

Banks today believe that technology is unreliable and expensive. To make matters easy for bankers reading this, do spend time with startups who can digitise you faster and make you nimble in managing your assets and ensure that the neo-banking journey is complete.

Route to complete digitisation

Digitisation is an ongoing progress, technology is always evolving and banks need a system that can dynamically adapt to change without compromising consumer or company data.

A study by McKinsey states that after the pandemic, companies are now seven years ahead in terms of digital transformation. Respondents at both B2B and consumer-facing companies most often cite a failure to prioritise as a barrier, but the responses to other challenges differ.

According to the report, a majority of the B2B respondents say that there is a fear of customer resistance to changes, which was a barrier, but only 24 percent of those in consumer-facing industries say this.

B2B executives most often cite organisational and technology issues: the required changes represented too big a shock to established ways of working, IT infrastructure was insufficient, or organisational silos impeded commitment to and execution of the required changes.

This about sums up why banking institutions are yet to digitise.

Benefits of complete EKYC

When there is complete digitisation – EKYC is performed remotely, allowing its users to complete these actions at their own comfort because all data is extracted from digilocker. Verification is completely automated and hence doesn’t require manual assessment. In the bank offices, this data goes to their Core Banking Systems without the necessity of keeping paper for compliance and audit purposes.

Digitisation leads to managing loan portfolios better. Along with stronger customer relationship tools there can be better sourcing of loans which also enables timely payments and reminders.

The new system is beneficial to both customers and banks:

To Customers

- EKYC is performed real-time.

- Customers don’t have to show up to the banks and financial institutes for queries.

- EKYC is comparatively faster and easier for the customer.

- There is a hassle-free onboarding experience and the procedure is done within a few minutes as compared to manual KYC which takes days and even weeks together, delaying the disbursement.

To banks

- Doesn’t require manual intervention. It is paperless and takes just minutes to verify and issue loans.

- Reduced scams and frauds with Aadhaar based verification connected to social media verification and video based verification.

- Improves customer experience for banks as it ensures real-time authentication.

The barriers that Givfin can break

There is a lack of speed in understanding the need of technology and executing on ideas of the future. There needs to be a mandate at the board level to go digital and very few organisations have the financial muscle to go in that direction of backing the digital journey.

givfin aims at providing all the solutions under a single platform and at a low cost model to enable banking institutions to embrace rapid digitisation. It uses artificial intelligence and machine learning to create a real-time contactless onboarding journey. With simplified steps, it is now convenient for anyone to operate.

With the givfin platform customers can onboard at speed and scale to have a seamless journey, through AI-powered facial recognition, liveness detection, OCR, and geo-tagging technologies.

It helps reduce onboarding time by up to 90 percent and also reduces operational cost by up to 70 percent. The givfin digital KYC algorithm can be used by banks, NFBCs, mutual funds, insurance, logistics, telecom Companies, Mobile Wallets, and P2P Marketplaces for a better customer onboarding journey.

Replace the traditional KYC, go givfin eKYC.